[SatNews] The construction of NewSat’s Jabiru-2 satellite has successfully been completed and the satellite is now in storage preparing for a 2014 launch.

Chief Technology Officer, David Ball noted, “We are pleased Jabiru-2 construction is complete and look forward to working with MEASAT as we continue to prepare for launch.”

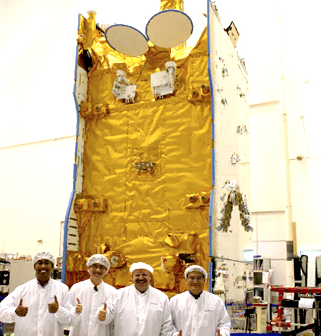

Courtesy of Astrium

Jabiru-2 was photographed during the pre-shipment review that took place this month. A large geostationary satellite, the MEASAT 3b satellite which hosts the Jabiru-2 payload has been built on the Astrium Eurostar 3000 platform. A reliable supplier, Astrium currently have 54 satellites in orbit, 12 under construction and this year accumulated more than 470 years’ successful operation in orbit.

“There is a lot of interest in Jabiru-2. Jabiru-2 will further facilitate NewSat’s services across the emerging and growth regions of Australia, Papua New Guinea, Timor Leste and the Solomon Islands. With high intensity zones and its focused capacity, Jabiru-2 will enable NewSat to deliver the high-quality, exceptional services our customers expect,” said Chief Commercial Officer, Scott Sprague.

Jabiru-2 is currently in storage at Astrium’s Toulouse site in France and once a launch date in H1 2014 is confirmed, the satellite will be securely transported from Toulouse to the European spaceport at Kourou, French Guiana.

Jabiru-2 will be launched by Arianespace on the industry leading Ariane 5 launch vehicle and reside in orbital slot 91.5 degrees E. The satellite will have a 15-year contractual in-orbit mission life, a launch mass of approximately 6 tonnes, a wingspan of 40m once its solar arrays are deployed in orbit, and a spacecraft power of 16 kW.

NewSat Trades Shares On The OTCOX

NewSat Limited (ASX: NWT), Australia’s satellite company, announces that the Company's ordinary shares (referred to in the US as “Common Stocks”), have commenced trading on the OTCQX in the United States by way of American Depository Receipts (ADR) under the ticker symbol “NWTLY". One NewSat Depository Receipt (NWTLY ADR) is equivalent to 100 NewSat ordinary shares. NewSat will continue to trade on the Australian Securities Exchange (ASX) under its existing code “NWT”.

OTCQX International is a segment of the OTCQX marketplace reserved for high-quality non-US companies that are listed on a qualified international exchange. This will complement NewSat’s listing on the ASX and US investors can access NewSat’s current disclosures at.

The OTCQX is an extension of the Company’s existing Level 1 American Depository Receipt (ADR), established in 2004. It provides an online platform for US investors to purchase NewSat shares in their time zone and will increase NewSat’s exposure to US investment communities.

The Bank of New York Mellon (BNY Mellon) will serve as NewSat's Principal American Liaison (PAL) acting as a bridge for NewSat to the OTCQX and providing NewSat professional guidance on OTCQX requirements.

Many companies around the world trade on multiple exchanges. Internationally, Adidas Group, BNP Paribas, Allianz and Zurich all trade on the OTCQX. Australian companies currently trading include Fortescue Metals Group Ltd, Linc Energy Ltd and Gulf Keystone Petroleum Ltd.

In commenting on trading on the OTCQX, NewSat Founder and CEO, Adrian Ballintine said: “Given the recent global interest in NewSat, we are delighted to qualify for trading on OTCQX. Trading on the OTCQX will complement our ASX listing and enable us to provide our US investors with relevant information and timely news to assist in the analysis, value and trade of the Company securities.”