[SatNews] But, the industry should not expect the fishing industry to be the ‘next big fish for satellite connectivity without a radical shift in technology or the fishing industry itself.

The recent wave of commercial airline connectivity deals is a prime example of the satellite industry moving into new markets, with a fresh path for growth. On the contrary, the maritime market has been a long-standing core component of the satellite mobility picture. With a time-honored history of providing communications into the middle of the oceans, what is left for satellites to connect? Does the fishing market provide the ‘new market’ opportunities… or is it just the same old song?

The quick answer, not necessarily. Fishing vessels remain as elusive as their catch – you need to know where to look, have patience, and bring the right equipment. Vessel Monitoring Services (VMS) will be a core component of satellite connectivity into the market, mostly by mandate. Last May, Globalstar and value-added reseller VehSmart announced a 4,000 fishing vessel trial program to outfit the Ecuadorian fishing fleet with satellite-based services. Elsewhere around the world, fishing management agencies continue to require vessels to be outfitted with some form of (typically) satellite monitoring service to monitor their fishery stock and provide various enforcement services. However, these are typically narrowband services under some form of government-sponsored or supported program. The real question remains if these devices and fisherman can convert to higher bandwidth and revenues customers.

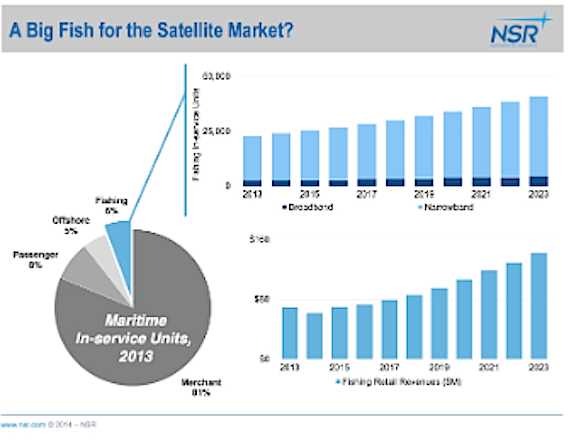

As NSR projects in its Commercial Mobility via Satellite, 10th Edition, the fishing market will yield slightly more than 40,000 In-service units (both narrowband and broadband) by 2023, and generate slightly more than $140M in retail revenues in the same year. Relative to other maritime markets in 2023, these are fairly unimpressive figures. Even from a modest base in 2013 (22,000 In-service Units and $70M retail revenues), the fishing market will show a slower growth over the next ten years. All cynicism aside, there is a growing need for connectivity, and providing broadband-centric services into the fishing market will be a higher-growth activity, accounting for almost half of all retail revenues by 2023.

As NSR projects in its Commercial Mobility via Satellite, 10th Edition, the fishing market will yield slightly more than 40,000 In-service units (both narrowband and broadband) by 2023, and generate slightly more than $140M in retail revenues in the same year. Relative to other maritime markets in 2023, these are fairly unimpressive figures. Even from a modest base in 2013 (22,000 In-service Units and $70M retail revenues), the fishing market will show a slower growth over the next ten years. All cynicism aside, there is a growing need for connectivity, and providing broadband-centric services into the fishing market will be a higher-growth activity, accounting for almost half of all retail revenues by 2023.Unlike other markets where broadband VSAT-based offerings will outpace broadband MSS-based offerings, MSS broadband offerings for fishing vessels will be a core component of the fishing market. With tight operating budgets, and relatively minimal overall bandwidth requirements, the business model of MSS offerings will fit the vast majority of fishermen’s needs. NSR does not believe business is nonexistent for offering VSAT products into the fishing market, but those will be limited to larger vessels that venture further from shore or are part of a larger industrial fleet. For them, cost will still be a key consideration, but with higher needs the ‘unlimited’ plans of VSAT-offerings will offer a better value.

So, beyond narrowband VMS-centric applications, what is driving the need for satellite communications in the fishing market? On the operations side, safety services, weather mapping, tracking/recording fish prices, business-centric emails are high on the list. On the crew/recreational side, voice/video/text communications with shore, TV, and social media are leading applications. Connecting personal devices likely still remain a ‘nice to have’ for most vessels, but like other maritime market, that is quickly changing. Overall, terminal cost and installation complexity will likely be higher considerations than systems integration for the vast majority of the market.

Bottom Line

The fishing market is more a cover version of a classic song, rather than a new hit. To the right service provider with the right combination of service, equipment, and price it could remain a profitable niche market. But, the industry should not expect the fishing industry to be the ‘next big fish for satellite connectivity without a radical shift in technology or the fishing industry itself.