[SatNews] The recent launch of a Japanese radar satellite (IGS-5) on an H-2A rocket is the latest indication that seeing through clouds at any time of the day is a continuing trend.

Initially devised to counter the testing by North Korea of missiles flying over its territory in 1998, the IGS-5 was the 9th military reconnaissance satellite that Japan has launched to date and the third synthetic aperture radar (SAR) satellite launched in the past 4 years. The satellites, coupled with other optical IGS’s already in orbit, afford Japan a portfolio of capabilities that also support civilian applications such as disaster management. With a reported ground resolution of less than 1 meter, IGS-5 is adding substantial capacity to allow reconnaissance of threats both on land and at sea, in cloudy weather and at night and at resolutions that most commercial SAR satellites cannot provide today.

In late December, it was a Russian-built Kondor-E satellite reportedly launched for South Africa that started gathering SAR imagery with details as low as 1 meter across.

As NSR indicated in its Satellite-Based Earth Observation, 6th Edition report, high resolution (HR) imagery is a much sought-after source of data not only from optical payloads but for SAR as well. Governments in Europe, North America and Asia are in line to get SAR imagery at better than 1 meter resolution from both commercial and military payloads. What does this mean to the take-up of commercial SAR imagery globally?

Major players in the market, e-Geos and MDA are generating a large portion of their revenues from SAR imagery already. And in the next few months, Hisdesat will enter the segment with PAZ, the first Spanish radar satellite, thus growing the number of countries that will own and operate radar satellites.

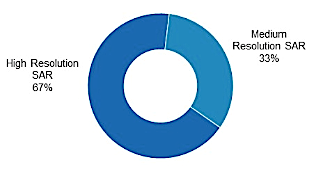

As the progression continues in available SAR ground resolutions, these players will help increase the number of customers for high-res radar data and generate $130 millions in annual revenues by the end of 2023, for a cumulative $900 million in the next ten years. Coupled with the near-demise of commercial markets for low resolution SAR data, the high-resolution market will take an increasingly large market share, raking in 67 percent of all SAR data revenues by then.

Add to the picture a more compelling value proposition with improved software and services to analyze what are complex datasets, and the market is set to expand further to more commercial and enterprise markets such as Energy. For example, searching for oil & gas and the risk associated with it has given rise to more usage of EO, which is a big benefactor of SAR interferometry, a technique vastly improved that has driven revenues from information extraction (slope stability, surface subsidence) to new heights and is increasing the market pie size. The impact of additional capacity will be more competition for SAR imagery, which will inevitably grow the addressable market and bring lower prices for each image.

Bottom Line

With applications diversifying the customer base beyond the traditional defense and intelligence community, SAR data markets will see a surge in available imagery in the coming years and enlarge the pie to more users. In a the continuing need to get better and more diversified sources of imagery, this surge coupled with more SAR high-resolution satellites is sure to be a key growth driver for both military and commercial EO data customers in the near future.