[SatNews] Of the BRICS economies, NSR expects Brazil to present the best growth opportunities moving forward.

Of the 5 BRICS economies, the one making the most noise in the satellite telecom sphere recently is Brazil. Indeed, it seems as though not a month goes by without the announcement of more capacity coming online or another big contract signed. This has led to questions of a capacity bubble, and whether there will be sufficient demand to soak up the staggering amount of capacity coming online. NSR’s BRICS Satellite Capacity Supply & Demand study highlights a number of potential issues and opportunities within each of the BRICS economies, with Brazil providing some of the most intriguing storylines.

FSS Analysis

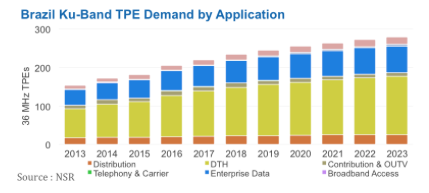

There are several factors to consider in the Brazilian market on the traditional FSS side. The most widely utilized frequency within Brazil, Ku-band, will see capacity more than double from 2013 to 2023, increasing from under 200 TPEs in 2013 to nearly 400 TPEs by 2023. This will lead to a dip in fill rates to around 65 percent in 2016, before rebounding to the low-70 percent range by 2023. Thus far, the capacity glut in Brazil has not curbed the optimism of operators there—indeed, local players such as Star One have continued to report high fill rates despite the entry of payloads from non-local operators, such as the launch of SES-6 in mid-2013. In particular, the Brazilian DTH market will see excellent demand growth due to a competitive market with strong impetus to upgrade to more HD content. DTH is expected to see demand double by 2023, from around 75 TPEs to 150 TPEs

HTS Analysis

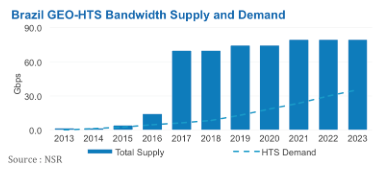

The HTS market in Brazil is currently limited to a number of spot beams on Amazonas-3. This payload will be dwarfed in/around 2017, with the launch of the Brazilian governmental payload SGDC-1, a satellite with 55 Gbps of capacity. Despite its size, the fact that it is governmentally supported means that fill rates will not necessarily be a great indicator of success. SGDC-1 will be utilized for not only Gov/Mil, but also broadband projects in second-tier cities as well as the Amazon where demand could take off. This may lead to some spillover demand as connectivity requirements outstrip capacity available in a given area; however, this would require a “wait and see” approach to take advantage of excess demand. Most HTS demand will come from Broadband Access, with ~30 Gbps of demand by 2023 accounting for 85 percent of total HTS demand. HTS fill rates are expected to approach 40 percent by 2023, but again, fill rates here will be brought down due to a governmentally-subsidized program.

How Will HTS Alter the Traditional FSS Landscape?

NSR expects some applications within Brazil, namely Enterprise Data, will see a degree of cannibalization by HTS during the forecast period. While Ku-band will still see solid growth coming from Enterprise Data to 2023, longer-term it is expected that the bandwidth economies of HTS will lead to a transition for things like VSAT networking from Ku-band to HTS. This will put some downward pressure on Enterprise Data pricing, particularly via Ku-band, while C-band Enterprise Data pricing is expected to remain flat.

Overall, HTS is expected to aim largely at new markets within Brazil, but some cannibalization will exist. The Amazon where broadband access demand can and will likely spillover to Enterprise Data for wireless backhaul services should lead to a transition from FSS capacity to HTS.

Bottom Line

Of the BRICS economies, NSR expects Brazil to present the best growth opportunities moving forward. Due to relatively friendly governmental policy, strong growth in video markets, and need for broadband connectivity, NSR expects much of the excess supply to be filled in the medium-to-long-term. However, in the short-term, a supply glut remains a real possibility, with the majority of new Ku-band supply in Brazil coming online between now and 2016. Therefore, any bet on the Brazilian market should be taken with an air of caution, and with the assumption that it will be a long-term play aimed at developing key customers and increasing bandwidth requirements, rather than making a quick buck in Latin America’s biggest economy.

You can find this report here.