[Satnews] As a rather slow-moving year came to an end, the land-mobile satellite market nonetheless saw continued growth in diversification of products and form factors such as hotspot devices, consumer-oriented handheld and push-to-talk (PTT) solutions. All these helped revitalize the MSS equipment ecosystem in a manner that mimics the mobile wireless market and helped spur growth as competitive pressures increased from terrestrial networks.

In its recently released Land-Mobile & SNG via Satellite, 3rd Edition report, NSR noted that this core market for the MSS players, be they operators, service providers or distributors, will show constant upward revenues over the next ten years. The rates for each will be wildly different, with the core satellite telephony showing a low single-digit CAGR. For MSS players to expect better performance, new and innovative solutions and channels to users are a must and will continue to be developed with a view to leverage mobile terrestrial networks, their stiffest competition, yet their biggest inspiration.

We saw a re-orientation take place many years ago as more consumer-oriented productssuch as the Globalstar SPOT and the Iridium InReach handheld form factors were launched. This new direction accelerated with the roll-out of the Thuraya SatSleeve, an ‘augmentation’ device that unmistakably put satellite into the hands of the fastest growing communications market, the consumer smartphone. Since then, four satellite-based Hotspot devices have also emerged, and two new push-to-talk solutions launched in 2015.

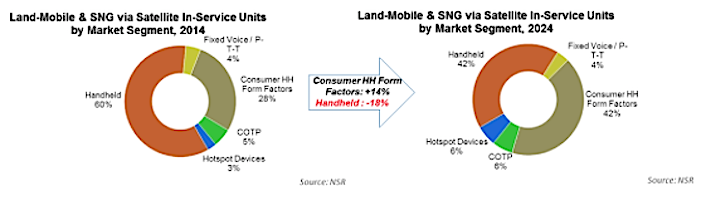

It is fair to say the drivers for Hotspot devices (such as the ISatHub, Iridium GO, Globalstar Sat-Fi and Thuraya SatSleeve Hotspot) are the various smartphone applications not historically supported with satellite when away from terrestrial networks. Much like the consumer handheld, NSR sees Hotspots as key for revenue to progress on a per unit basis as these are strongly dependent on, and designed for, customers’ use of fast-growing and established social network applications such as Facebook, Snapchat, Instagram and Twitter. NSR estimates Hotspots and Consumer handheld form factors will each grow their market share on a per unit basis by 3 percent and 14 percent respectively over the next ten years, while at the same time satellite handhelds will drop more than 18 percent.

Another example of MSS services moving in step with the greater telecom market was the late November agreement between ViaSat and Cobham for a combined vehicle-mount and PTT solution. The solution uses LightSquared satellite capacity with a flat rate service plan and a seamless transition between cellular and satellite. Earlier in the summer, Iridium launched its Extreme PTT handset to leverage its military version of push-to-talk to reach deeper into first responder, utilities, forestry and fishing markets with lower price points on a monthly basis than current satellite phones.

For its part, Thuraya announced last September that the SatSleeve+, which added a universal smartphone adapter, would sell through non-traditional channels via an agreement with online retailer Expansys and, since late in December 2015, through mobile operator Etisalat.

Bottom Line

The land-mobile via satellite market has entered a more dynamic product and distribution network development phase than ever before, and many recent hardware launches have reinforced this notion. This renewal is key to expanding the user base and find pockets of growth with an expanded portfolio of solutions to keep market share and grow margins. With more wireless network build-up ‘invading the footprint’ of satellite networks, we can expect more land-mobile consumer-oriented (or –inspired) products that leverage and mimic advances in the mobile wireless market to sustain growth going forward.