No small achievement, flat panel satellite antennas have long dealt with cost and performance issues. Currently with the growing demand for in-flight connectivity more phased array antennas are being developed, which has initiated a demand across other verticals such as land-mobile and maritime. This NSR reports addresses this issue.

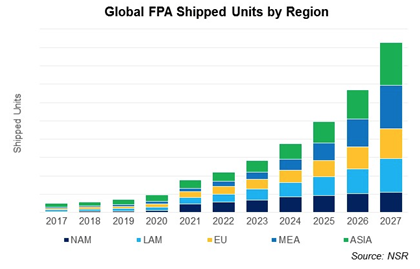

NSR’s Flat Panel Satellite Antennas, 3rd Edition (FPA3) report, just released, forecasts cumulative FPA equipment sales to reach $7.9 billion by 2027. As the only multi-client report on the FPA market today, NSR’s FPA3 finds aeronautical equipment will drive revenue growth for manufacturers, while fixed broadband applications on non-GEO satellites will be the main, long-term volume market.

While flat panel antenna technology, more specifically phased array antennas, have been deployed for many years, cost and performance have been major obstacles inhibiting the wide acceptance of this technology. “The growing demand for in-flight connectivity, plus the necessity of using a low profile for air-drag concerns, justifies the development of complex phased array antennas in the commercial aeronautical market. This development has allowed the tide of technology to rise across other verticals, allowing for the entrance of FPA manufacturers targeting the land-mobile and maritime sectors,” stated Dallas Kasaboski, NSR Analyst and report lead author. “Concerning satellite broadband, every day brings us closer to the potential deployment of non-GEO satellite constellations. Yet, the fast beam-steering and pointing required to connect with these satellites will necessitate improvement on ground equipment technology, and only once prices drop to better compete with parabolic antennas will we see a large take-up of FPAs for fixed applications.”

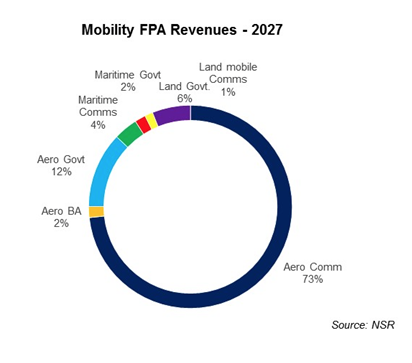

Given increasing in-flight connectivity (IFC) take-up by airlines, growing demands from the maritime passenger segment, and the established land government vertical, NSR expects FPA equipment revenues from mobile applications to dominate the forecast, responsible for 92 percent of the market share by 2027. Mid-way through the forecast, as LEO-HTS constellations such as those planned by OneWeb and SpaceX are launched, NSR expects economies of scale and overall improved FPA performance to allow manufacturers to target the large addressable markets for satellite broadband and enterprise connectivity.

Currently, at least twenty manufacturers are in various stages of development and deployment of FPA solutions. NSR’s FPA3 details the progress of each and the growing maturity and partnership seen in the industry value chain, which will drive cost and performance improvements, allowing for more successful business models and greater access to satellite communications worldwide.

About the Report

As a thought leader, NSR is first at assessing the business, technical and regulatory issues facing FPAs. NSR’s Flat Panel Satellite Antennas, 3rd Edition report provides a 360-degree overview of the FPA market, forecasts the global industry growth in terms of shipped units, in-service units, and equipment revenues across nine regions and across five different type of services for both FSS and HTS. The market drivers and restraints that NSR believes will lead to market growth in the next ten years are clearly explained to offer a wider outlook as to what the future holds for stakeholders. NSR also profiles all the key companies building such FPAs.

NSR’s Flat Panel Satellite Antennas, 3rd Edition (FPA3) report is the industry’s leading source for data and analysis on this groundbreaking area for satcom development. Flat Panel Antennas (FPAs) have been on the brink of widespread commercial success for years, due to the promise they hold for replacing traditional parabolic VSAT antennas in many satellite markets. Smaller, lighter form factors, combined with innovative technologies and the potential of increased capability, are the main selling points for FPAs. However, heritage systems, higher prices, and low technological development remain as the main obstacles for FPA growth. Despite these challenges, recent collaboration in the satellite value chain, combined with increasing interest and investment in FPA technology, make 2018 the year FPAs are expected to hit the market en masse.

NSR’s FPA3 report is structured into 2 parts – Broadband Mobility and Fixed Applications. Mobility sections are further broken down into three vertical markets – Aeronautical, Maritime, and Land-mobile, whereas the Fixed Application segment consists of three vertical markets – Broadband, Backhaul and Satellite Video. NSR's 3rd edition of this report forecasts the growth of FPA in-service units, shipped units, and equipment revenues across five regions and by frequency band/s of operation. NSR’s forecasts are scenario-based, offering the reader with different paths this market can take, with drivers and restraints clearly explained for the same.