[Satnews] With capacity prices in a state of freefall since the start of HTS operations, it is clear the SATCOM industry is in a state of transformation.

NSR this trend of dropping capacity prices is not part of a cyclical supply and demand balance, but a major technological & industry shift.” Flat Panel Antennas (FPAs), with low profile and high bandwidth efficiencies, are a significant part of this technological and business model change the satellite industry is currently undergoing.

Though lower capacity prices may have reduced the entry barrier for SATCOM services to unlock consumer-facing markets like broadband, capacity leasing is just a part of the HTS business puzzle. Many satellite industry past failures have been due to expensive ground terminals or poor quality of service. The importance of satellite ground segment for the success of HTS services was recently highlighted by the sheer number of booths at a recent satellite trade show dedicated to new antennas, modems, bandwidth management software and RF equipment. But despite the choices being many, selecting the right FPA is a complex issue and is expected to remain so in the future as no single FPA solution fits all markets.

NSR’s recently launched Flat Panel Satellite Antenna Analysis report analyzed FPA impact on the satellite market and found that bandwidth efficiency, high pointing accuracy, superior beam steering, and regulatory clearance are among the important criteria for FPA selection by system integrators, along with the price tag. An evolving industry ecosystem, consisting of partnerships between satellite operators, service providers, and ground equipment manufacturers, is an indication that the satellite industry has learned from past mistakes of ignoring the significance of ground segment and is trying to work collaboratively for achieving the right mix between performance and price.

A challenge with current generation HTS is that bandwidth demand is not constant across spot beams, making demand planning difficult for satellite operators and service providers, especially in mobile broadband services. Hence, higher throughput terminals that are spectrally efficient and can switch seamlessly from beam-to-beam clearly help deal with this issue. Of late, many manufacturers have offered different types of FPAs to satiate rising demand, like Gilat, Boeing, Honeywell, Qest, and Rockwell Collins (among the established vendors) and Phasor, Kymeta, Isotropic Systems, GetSat, Satixfy, and SatPro (among new vendors).

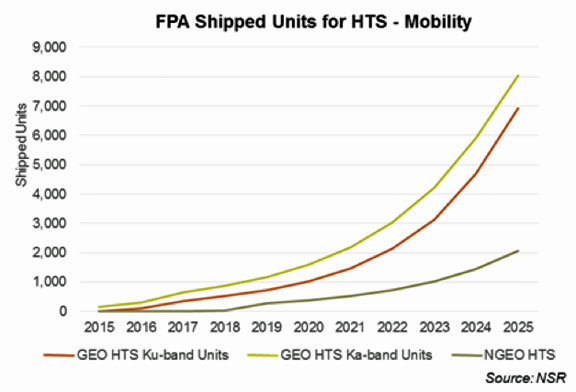

NSR believes that FPAs, especially the electronically-steered variety, are a key technology for unlocking higher satellite bandwidth efficiencies with minimum weight penalty, which is critical in mobility. However, FPAs are not expected to be a substitute for the traditional parabolic VSATs in every market. There needs to be a match between FPA value proposition, operational constraints, and end-user needs, which cannot be met by cheaper parabolic VSAT alternatives, to build a case for FPAs. NSR expects HTS driven mobility services like aeronautical, land-mobile, and maritime connectivity to steer growth for FPA manufacturers. In NSR’s Flat Panel Satellite Antenna Analysis report, more than 31,000 units are forecasted to be shipped only for satellite mobility, at a CAGR of 28 percent, by 2025, with more than 50 percent of these antennas estimated to be used with HTS capacity.

The antenna driving mechanism is another major trade-off factor for system integrators in weight- and size-sensitive markets like land-mobile and aeronautical connectivity, and NSR expects electronically steered antennas to form the majority of FPAs in the next decade for the maritime and land-mobile market because of their low weight and easy installation process. Whereas, mechanically-steered antennas still have a leg up in the aeronautical market for the next ten years because of their first mover advantage in a market that has high barriers of entry, and also due to the rigorous antenna performance requirements.

The fact that connectivity is no more seen as a commodity, but a necessity today, has been driven by the ICT revolution in the past two decades. Adam Smith, in his economic masterpiece ‘Wealth of Nations,’ considered technological change as a social process. According to him, only those technologies reach the market that maximized the profits for the owner with incoming capital. Mapping his idea in the context of the satellite industry, NSR believes that FPAs are an endogenous factor in the technological change process of the satcom services industry for mitigating the effects of falling capacity prices on revenues.

It is essential for satellite operators and service providers to have effective bandwidth optimization strategies before adding more capacity to their network in order to avoid detrimental effects on profit; they also need to remain on top of their game as the environment will only get harsher from here. Selling capacity in Mbps instead of MHz is merely going to surmount bandwidth management woes for satellite operators, as quality of service will vary with the demand variabilities. And this is why, the next generation of FPAs, offering multiple beam scanning capabilities with high bandwidth efficacies, is the innovation that the satellite industry needs, as well as deserves right now.