The continuous change in the SATCOM industry is expected to define a SATCOM 3.0 era in the coming years. SATCOM 1.0 started with FSS and Video/DTH in the 1980s, and then SATCOM 2.0 signaled the arrival of HTS in Ka-Sat, ViaSat-1 and Jupiter-1 in 2011-13, enabling broadband and mobility applications.

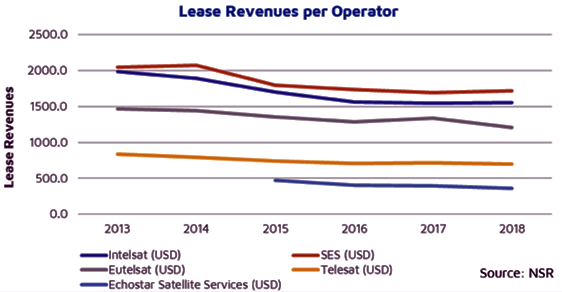

Today, we are truly entering a new era, with a shift from video to non-video, lease to service and subscription mode, packing more than a Gbps at less than a million dollars and making bets that extend from thousands to millions in scale. This fundamental shift has also given many headaches to operators on how to future-proof a fleet strategy, particularly when lease revenues are in a constant decline across the industry as stated in NSR’s Satellite Industry Financial Analysis, 9th Edition report:

Choosing an option depends on the operator’s size, risk appetite, target application and target B2B/B2C models (including right demographics). For example, Consumer Broadband is inherently riskier and mass market as compared to backhaul – given the amount of ecosystem dollars that need to be spent. Flexibility remains key in the wake of high regional competition – and thus a correct mix of fleet strategies is important to convert nascent market positions into leadership positions, and ultimately captive market positions. NSR sheds insight into the key trade-offs for each option as below:

Then the question arises – which fleet building strategy will work? It depends on the operator, underlying financials, captive market competition, and business/pricing strategy.

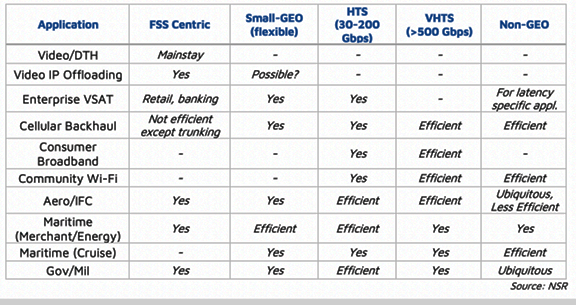

Organizational structures play an important part in deciding the pace of the business. Any leapfrogging would be risky, and long-term strategy would need to show better price economics than competitors and create captive markets to mitigate short-term risk. The following table showcases which fleet strategy might be most suited or efficient for a target application – differentiating among Efficient (target fleet for this application), Yes (doable, but not the most efficient), and other comments like ubiquitous coverage (specific for non-GEO) or mainstay (FSS Video that has been 65 to 70 percent of industry revenues in the past three to four years).

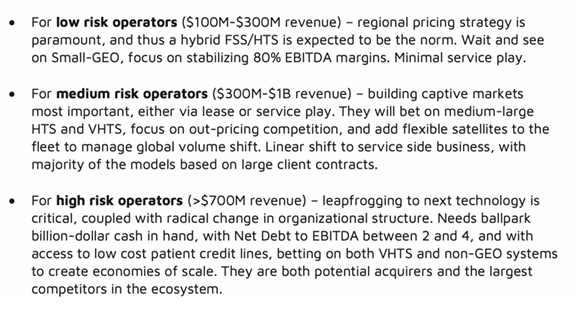

The SATCOM 3.0 growth phase is here to stay, defined by large volumes and low prices unlocking more geographies and diverse demographics. Operators should expect intense competition and build tools to differentiate themselves from their business competitors. The hardest tool to build is their fleet, due to a lifetime that is 2 to 3x lengthier than tech cycles, but also quite controllable internally. NSR’s preliminary classification based on risk involved are noted as:

Gagan Agrawal

Analysis and report by Gagan Agrawal