In the last few months alone, aeronautical in-flight connectivity (IFC) service providers have made numerous new deals with satellite operators for FSS and HTS capacity. Indeed, the latest announcement came from GoGo with SKY Perfect JSAT to expand FSS Ku-band services over Japan and the Pacific. As noted in NSR’s Aeronautical Satcom Markets, 4th Edition report, what the flurry of mostly HTS capacity deals also underlines is a trend of continued demand for a mix of both FSS and GEO-HTS capacity, but with differing price trends and associated revenue impact for each.

For providers of FSS Ku-band capacity, it would seem the big shadow of GEO-HTS looming large over their market places pressure not seen before over this established sector of the aero satcom market, which could pale in comparison in terms of bandwidth available, performance and suffer higher pricing decreases. Still, even if FSS comes under fire from newer technologies with higher throughput and lower cost per bit, many aircrafts, both on the commercial airline side as well as in the business jet market, will remain customers of FSS, which today is used by more than 20 airlines worldwide, compared to about a dozen that have signed up for GEO-HTS capacity.

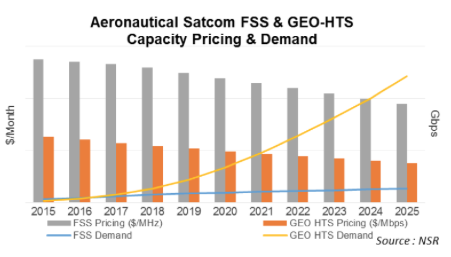

But while FSS aero demand continues to grow by about 10 transponders on average per year, NSR forecasts average FSS Ku-band pricing to drop at a -3.7 percent CAGR ($/MHz/month) over the 2015-2025 period. It is a resilient type of capacity with more availability of supply expected, which will be advantageous for the long-haul market where about 50 percent of FSS Ku-band demand will originate. And even if airlines migrate from FSS Ku-band to GEO-HTS, a large number of aircraft will ‘switch’ back and forth between the two types of capacity on their journeys, due to cabin connectivity usage, travel routes and of course satellite coverage. It is quite likely that many of GoGo’s 1,000 aircraft contracted to fly with their 2Ku system will be found in these numbers, and perhaps it had this switching in mind when it contracted for capacity on the JSAT satellites.

Still, pricing will directly impact capacity revenues for operators with close to 0 percent annual growth in the 2020-2025 period due to increasing coverage brought about by competing GEO-HTS capacity, which looks promising even if it also will battle decreasing capacity pricing.

Indeed, all IFC service providers (SPs) today have HTS capacity in their capacity portfolioand by all accounts, NSR estimates that more than a dozen Gbps on about 15 GEO-HTS satellites were contracted so far by these SPs. And more is to come, with HTS satellites launching this year for Intelsat, Telesat, SES and EchoStar (HNS), among others. However, with HTS comes other factors that impact demand: FSS and HTS capacity ‘toggling’, roaming across different networks, complex network management across spot beams to adhere to SLAs, service ramp-up across fleets, bandwidth prices and margin decreases, vertical and horizontal consolidation, customers’ expectations, tiered services, and more.

But there are underlying factors at play, notably for GEO-HTS Ku-band where backwards compatibility with FSS Ku-band will offer a strong value proposition. Even if we see more GEO-HTS Ka-band satcom units flying today, fewer contracts were signed for this type of capacity, due mostly to lower available bandwidth in the mid-term and a more regional play. Nonetheless, a drop in bandwidth price of approx. 5-10 percent CAGR over the forecast period is expected and without that decline, revenues for GEO-HTS would shoot up in the latter part of the 2015-2025 timeframe.

The Bottom Line

A large outlay of supply in the market will bring fierce competition to the established FSS Ku-band aero connectivity market and affects pricing and thus operator revenues. But as HTS systems are installed at a fast rate and GEO-HTS satellite coverage grows, a high number of FSS Ku-band units already flying will continue to be widely available and provide IFC capacity in complement to GEO-HTS. Even as the race to offer more capacity for in-flight connectivity heats up, and the latest announcements point to GEO-HTS capacity growth, many SPs will still look to FSS Ku-band as a persistent and dependable solution for the aero satcom market.