While generally not driving as much hype as other technology trends in the satellite ecosystem, Ground Segment virtualization is arguably one of the most critical transformations the industry will experience in the coming years, as noted in NSR’s Commercial Satellite Ground Segment, 4th Edition report.

Key to enabling scalability and flexibility of the networks, infrastructure vendors, integrators and operators are racing to adopt a new virtual framework. What are the key aspects of this transition?

A Technology Leap

From the smallsat revolution to EO constellations, VHTS satellites, Software Defined Satellites or NGSO constellations, the pace of satellite industry innovation has accelerated to unprecedented levels. NSR believes Ground Segment innovation is a critical element of this innovation cycle, as only through advances on the ground can the industry adapt and support new demands across the new, virtual satellite ecosystem.

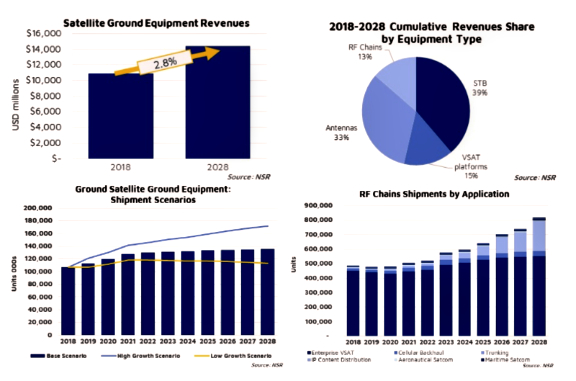

Scalability (multiplying number of beams and satellites, skyrocketing throughput, increased number of terminals) and flexibility (software defined payloads, network resource orchestration, network entry point diversity) in their wider sense are some of the biggest challenges ground segment developers need to respond to. While there has been tremendous progress in ground segment technologies in elements like throughput, efficiency and traffic optimization, there needs to be a leap change in the cost per Mbps of networking elements to maintain investments in the ground segment relative to the total system cost at assumable levels. The industry, therefore, needs to embrace virtualization to reduce the unit costs of ground equipment while meeting the new requirements imposed by smallsats, constellations and VHTS.

Solutions for the New Ecosystem

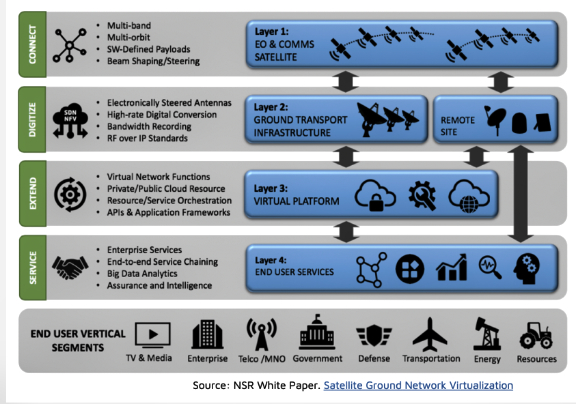

Various stages of the ground segment are already being virtualized to leverage economies and scale of generic computing capabilities and offer new capabilities. For example, in the TT&C space, actors like Kratos and Amergint are leading the transition with virtualized ecosystems (modems, FEP, flexible mesh capabilities, WAN optimization tools, data processing) due to the great benefits these offer to their customers. Similarly, in the VSAT space, elements such as the NMS are rapidly moving to the cloud given new networking requirements (mobility, beam shaping).

However, one must bear in mind that generic equipment might still be unable to meet the performance requirements for some of the networking functions. RF electronics is still hard to emulate on generic equipment, and baseband units will likely continue to rely on specialized hardware for the foreseeable future, except for specific use cases.

Implementation and Business Models

What does this all mean? Satellite should avoid the mistake of having to reinvent the wheel in this transition by adopting best practices from terrestrial. In fact, the transition to the cloud is a great opportunity to make satellite seamlessly integrable with the general telecom industry. SES adoption of ONAP standards for network automation and service orchestration is a great example of this.

Similarly, many of the new concepts like flexible resource allocation, SDN and NFV are being standardized under the 3GPP/5G umbrella. Traditionally, satellite has operated with proprietary technologies and siloed Operational Support Systems, where service configuration was custom-made. 5G will remove these silos to standardize service orchestration, giving operators and service providers the flexibility to tailor their network services.

Adoption of 5G standards will have multiple implications. From a market point of view, satellite will be much easier to implement for general telco users, kick starting a number of new use cases. From an operations point of view, virtualization and 5G will trigger a re-evaluation on how infrastructure and network capabilities are procured, prompting new business models such as “Infrastructure-as-a-Service”.

Bottom Line

The satellite industry is in the midst of a period of accelerated innovation with smallsats, constellations and VHTS. However, there is a real and large risk that the ground segment may become a bottleneck in all these innovative developments rather than the key enabler that leads to closing the business case for next-generation programs.

Embracing virtualization is critical to respond to new scale and flexibility requirements. Moreover, virtualization opens a window of opportunity for satellite to become seamlessly integral with terrestrial solutions, thus unlocking new use cases. One must not underestimate the depth of transformation triggered by virtualization as business models around procurement of infrastructure and network capabilities will lead to new opportunities, revenue streams and emerging value propositions.

The pace of innovation in space and on the ground have to be linked. More importantly, the offerings envisioned for satellite 3.0 also have to be on the same page. Developments and offerings on the road ahead have to coincide not only with the needs of the satellite industry, but more so with the needs of terrestrial service providers if satellite is to gain larger share of the telecom/telco pie.

(Article authored by Lluc Palerm-Serra, Senior Analyst, NSR)