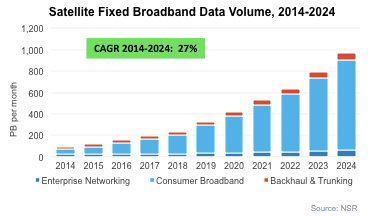

[Satnews] Terabit satellites, LEO mega-constellations, subscribers counted in millions, flexible data caps, OTT over satellite… Recent announcements in the satellite industry hint at an explosion in data volumes. But are these expectations part of the current “Silicon Valley” fever, or is there evidence supporting these prospects? In the recently released VSAT and Broadband Satellite Markets, 14th Edition Report, NSR forecasts data volume for Satellite Fixed Broadband to grow at a CAGR of 27% over the next ten years, but this growth must be placed in proper context.

This unprecedented push in data volume via satellite (and thus capacity demand) is driven by both the addition of new Consumer Broadband subscribers and the higher consumption of bandwidth per site. While Enterprise Networking and Backhaul & Trunking sites will grow at moderate single-digit rates, Consumer Broadband subscribers are forecast to grow at double-digit CAGRs in all regions in the next 10 years.

Data consumption per site will greatly increase across all verticals driven by the migration to 3G/4G for Backhaul, video rich applications and Internet connectivity needs for Enterprise Networks, and OTT and other bandwidth hungry applications for Consumer Broadband. But how does this exponential development in volume & satellite capacity demand correlate with the general IP traffic outlook?

A Drop in the (Blue) Ocean

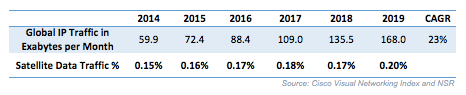

Looking from a traditional satellite communications perspective, this demand explosion might seem extravagant. However, when compared with global IP traffic forecasts, trends for satellite data traffic volumes resemble very much those for general IP traffic.

Cisco’s Visual Networking Index forecasts global IP traffic passing the zettabyte threshold by the end of 2016. Fixed Satellite data traffic will contribute a mere 0.17% to that data volume. More interestingly, comparing how the networks will grow, global IP traffic will grow at a 23% CAGR between 2014 and 2019, while satellite broadband capacity demand will grow slightly faster at a rate of 29% in the 2014-19 period.

Subscriber growth for ground networks is slowing as they face difficulties in further expanding their reach and as many markets become saturated (The State of Broadband 2015 - ITU & UNESCO). Conversely, Satellite Consumer Broadband is still a “blue ocean” proposition with huge subscriber growth opportunities. In the U.S., there are approx. 1.6M satellite Internet households compared with 4.8M sites still using Dial-Up connectivity. All in all, NSR forecasts global satellite broadband subscribers to grow by a factor of five in the next ten years.

Satellite broadband is not made for heavy OTT consumers, but usage patterns resemble very much those for the regular ground network user. The general trend to higher data consumption together with a new focus on premium plans and flexible data caps will increase data consumption per site.

Combining the effects of the expansion of the customer base and a higher capacity consumption per site, it is logical that satellite broadband capacity demand grows faster than global IP traffic.

Bottom Line

With demand for satellite broadband capacity growing at a 27% CAGR in the next 10 years, it is obvious this is a massive opportunity for the industry. Most of this growth stems from newly acquired subscribers in the consumer broadband vertical.

However, it is essential the industry understands that markets are changing very rapidly and, therefore, it is necessary to constantly rethink the business model: from how satellites are conceived or the challenge of developing a distribution arm, or to how performance of the assets is measured.

In the end, although satellite data traffic is exploding, it is still well below 1% of the globe’s data consumption levels. HTS has brought a game change into the satellite industry, but it has only allowed the industry to keep up the pace of the global IP traffic development.