Pricing of satellite Earth Observation (EO) data has been a puzzle for the industry for many years, which has time and again prevented data commoditization to markets beyond the government.

The high CAPEX of building and launching large imaging satellites could only be justified with premium anchor tenant customers, which has mostly been the defense and intelligence community. However, small satellites are set to change this status quo by using COTS components to reduce build-to-launch time, project cost, and technology refresh. By targeting the commercial EO markets, new players have been able to only partially deliver on the promise of bringing down the price of EO data, due to the inelastic nature of this market where supply has always outgrown demand.

NSR’s Satellite-Based Earth Observation, 8th Edition, report analyzed the impact on EO data pricing as more supply comes to the market, demand builds up from downstream applications like analytics, and the competitive landscape heats up with a number of constellations reaching full strength by turn of this decade. NSR found the pricing evolution of different types of EO datasets—by resolution and by sensor type, and how the trends vary within each of these sub-segments.

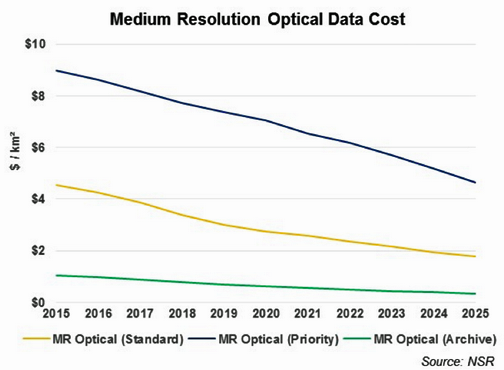

For instance, the pressure on optical medium resolution (MR) imagery—from data between 1 meter and 5 meter ground resolution—is expected to vary depending on the time taken to deliver these images to the end-customer. While ‘priority’ MR optical data price decreases at a CAGR of 6.4 percent, the price of the same data purchased as archives decreases by a much larger 10.4 percent CAGR. Meanwhile, the pricing margin between priority and archived MR optical data was found to increase from 430 percent to above 500 percent during the same time period, indicating the erosion rate of EO data price is also dependent on the lead time for delivery, apart from the common factors of demand, supply, and competition.

The slower rate of erosion of priority or rush-mode satellite imagery pricing is due to the niche customer base, which values such a premium paid for fast and timely delivery, and this becomes a distinguishing factor apart from image quality, resolution, and persistence. Access to these premium customers has allowed EO satellite companies to operate on high margins (on a $/km2 basis), which creates a market asymmetry as other operators with a majority of non-premium customers have to rely on reselling images of the same area multiple times, or invest in their image collection capacity.

As satellites are integrated into the digital economy, the addressable market size is rapidly expanding, assisted by development in computing technology, Artificial Intelligence, and increasing awareness about value of satellites. But the ‘tipping point’ analysis for having a business case will continue to be around data pricing, as small satellites keep bridging the capability gaps with larger satellites, thanks to Moore’s law, and drive competition in both traditional and new markets at much lower data prices, which imposes pricing pressure on the overall market.

NSR expects archive and standard spot image pricing to be affected more by the impending supply of EO data and a toughening competitive landscape. However, an erosion of the premium from imagery tasked on a priority basis will also occur as the number of options to choose from EO companies increases. Demand for EO data-powered services will continue to grow, and EO satellite operator business models for entering new markets also have to evolve accordingly. But the margins at which traditional satellite operators function is bound to decrease moving into the future, both due to market driven pressure as well as an intentional strategy to take out competition.

nsr.com/research-reports/satellite-space-applications/satellite-based-earth-observation-8th-edition/