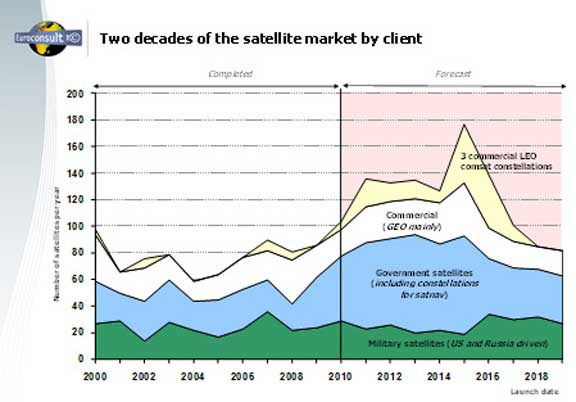

The average of 122 satellites to be launched per year is up significantly from the annual average of 77 satellites launched in the previous decade, a sign that government and commercial operators require more satellite capabilities. In Euroconsult’s just-released "Satellites to be Built & Launched by 2019, World Market Survey," the company projects that revenues from the manufacturing and launch of these 1,220 satellites will reach $194 billion worldwide for the decade. The report concludes that governments around the world will continue to dominate the space market, accounting for two thirds of the total number of spacecraft launched and the same amount of launch and manufacturing revenues.

Civilian and military government agencies in 50 countries will launch a total of 808 satellites in the next decade, with two-thirds of these satellites designated for civil or dual use. The military space market remains concentrated in a limited number of countries (USA, Europe, Russia, China, Japan and Israel). Despite the fact that defense and security agencies prefer proprietary military satellite systems for communications, imagery intelligence, and space surveillance, budget constraints will encourage alternative solutions such as public-private partnerships (PPP) and government payloads hosted on commercial satellites, the report predicts.

In non-military areas, governments are expected to procure satellites for operational missions in Earth observation, meteorology, navigation, and communications. The Euroconsult report says that governments will also develop more missions for space science and exploration, as well as launch technology demonstration missions to qualify future satellite technology and validate new applications like automated identification systems (AIS). Earth observation is expected to be the dominant application with a total of 267 satellites projected over the next decade as more governments order and launch satellites through national space agencies, multilateral agencies and public-private partnerships for both civilian and military uses of satellite optical and radar imagery.

At $128 billion over the decade, the government market is double the commercial market, but it is largely closed to non-domestic manufacturers. Most of that market is for satellites destined for low Earth orbits (46 percent) with higher altitude orbits (GTO, MEO, HEO and deep space) making up the difference. Commercial space is dominated by 50 companies operating communications and broadcast satellites in geostationary orbit. The two largest companies, Intelsat and SES, have a fleet of more than 40 satellites each. The commercial space market is driven primarily by established operators’ investment cycles as they replace aging capacity in-orbit, and to a lesser degree by new systems promoted by new commercial companies and governments. Because technology advances allow construction of GEO satellites of ever increasing capacity, operators can expand satellite services with fewer satellites. These advanced satellites are heavier, which also drives the size and performance of launch vehicles.

Euroconsult forecasts 214 commercial communications satellites will be launched into the GEO arc during 2010-2019, with a market value of $55 billion. The peak of the cycle will occur early in the decade, with 25 units to be launched per year, declining to fewer than 20 units per year at the end of the period. Commercial satellite services outside the geostationary orbit will get a boost with a total of 200 satellites to be built and launched into medium and low Earth orbits (MEO and LEO) during the period. Most of them (80 percent) will be communications satellites to replace the first LEO generation operated by Iridium, Globalstar and Orbcomm and to create the first generation constellation of O3b, an innovative system to be launched into MEO. Additionally almost 40 satellites will be launched into low Earth orbit for commercial optical and radar imagery (e.g., Infoterra, GeoEye). According to Euroconsult the $11 billion in revenues generated by the manufacturing and launch of these satellites will remain small compared to GEO comsat.

The 13th edition of Satellites to be Built & Launched by 2019, World Market Survey is the landmark study for all industry actors concerned with satellite systems and their launches. The report provides all information key to understanding the global space market, present and future. The report includes exclusive 10-year forecasts including breakdown by customer and by orbit, number & mass of satellites to be manufactured and launched and market value. The report offers a review of strategic issues from both supply (industry) and demand (customers) perspectives and a performance analysis for eight leading suppliers. It also includes a comprehensive and detailed demand database for commercial and government satellites including: application, launch date, satellite platform, manufacturer, launch provider.