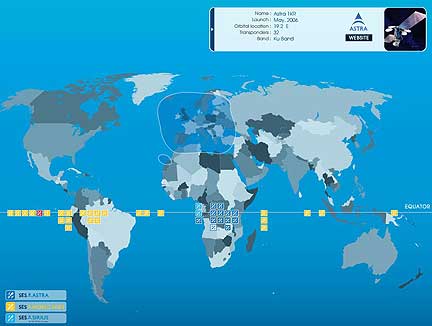

Romain Bausch, President and CEO, commented: "We are pleased to report that 2009 was another year of robust performance by the SES group, with continued strong demand for satellite capacity driving revenue growth. SES also built significantly on its profitable base, through acquisition and investments, to further develop the foundation for future growth. During the year, SES contracted five additional satellites, so that there are currently 12 satellites under construction. Our intensive satellite investment program is projected to deliver over EUR 400 million of new annual revenues in the 2015 time horizon. Further growth will come from SES' minority investment in O3b Networks, a satellite constellation that will bring high-speed, low latency Internet trunking to markets which have little or no broadband connectivity. We have, therefore, excellent growth prospects, as also reflected in the increase of the contract backlog, and we look forward to continuing to deliver value to shareholders."

Here are some of the financial highlights:

- Revenue rose 4.4% to EUR 1,701.6 million (2008: EUR 1,630.3 million)

- Recurring revenue of EUR 1,682.8 million, an increase of 1.7% over the prior year period

- EBITDA up 8.1% to EUR 1,189.5 million (2008: EUR 1,100.0 million)

- Recurring EBITDA of EUR 1,220.2 million, an increase of 5.2% over the prior year period

- EBITDA margin of 69.9% (2008: 67.5%)

- Recurring EBITDA margin of 72.5% (2008: 70.1%)

- Recurring infrastructure EBITDA margin of 82.9% - the highest so far recorded in the industry (2008: 81.6%)

- Operating profit increased by 12.0% to EUR 700.4 million (2008: EUR 625.1 million)

- EPS rose 24.5% to EUR 1.22 (2008: EUR 0.98)

- Dividend increase of 10.6% to EUR 0.73 per A-share proposed (2009: EUR 0.66)

- Net Debt/EBITDA of 2.99 times at year end (2008: 3.16)

- Contract backlog was EUR 6,748 million (2008: EUR 5,850 million)

The entire SES press release can be viewed at .