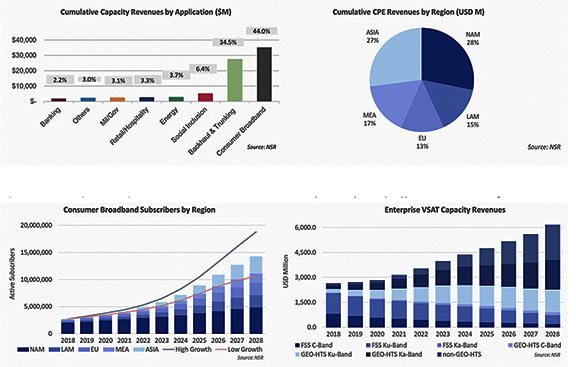

NSR's VSAT and Broadband Satellite Markets, 18th Edition report forecasts healthy revenues in the next decade, with Enterprise VSAT gaining a slight edge over Consumer Broadband, accounting for greater than 50 percent of total revenues — Backhaul and Trunking will be the key application globally, but broadband to households, consumers, and hotspots will account for healthy demand as well.

The satellite broadband ecosystem is in its transition phase with multiple ongoing parallel developments. Vivek Suresh, NSR Analyst and author of the report, said that incumbents extending to new geographies, emergence of GEO/MEO/LEO HTS offerings, entry of new players, innovation in the ground segment, dropping capacity prices, new solution offerings, system upgrades, and new business models; all add to a chaotic, but game-changing, recipe where ecosystem development will lead to market growth.

On the capacity demand front, resonating with demand and the falling in-orbit asset cost per Gbps, satellite operators are launching additional capacity globally. As a result, pricing is shifting closer to USD $200/Mbps/month for HTS Ka-band and USD $300/MHz/month for wideband capacity. Vivek added, that prices are likely to drop further with the influx of VHTS and non-GEO HTS platforms, during the period 2021-2023; unlocking price elasticity across different applications. With falling capacity pricing, it becomes critical for operators to invest in the right strategy for consistent growth.

Why is satellite broadband so attractive? First, there is a large potential for Consumer Broadband where satellite services currently cover only 0.63 percent of the total addressable market. This represents a sustainable and high paced growth opportunity over the long term. However, this market segment is extremely price sensitive, and a uniform ARPU will not be applicable for service penetration across all regions. Operators and service providers will have to execute lower service fees with slim profit margins, especially in the developing regions of Latin America, Middle East/Africa, and Asia. Vivek noted, that the key to generating higher service revenues from the Consumer Broadband segment is service scalability. The next generation of HTS, VHTS, and LEO satellites are the major market growth drivers. Plus, the Enterprise VSAT segment’s healthy ARPU will generate sustainable service revenue growth across multiple applications.

Vivek Suresh Prasad

Story by Vivek Suresh Prasad, NSR Analyst, Bangalore, India