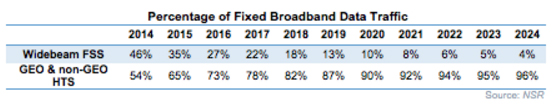

[Satnews] According to NSR, 2016 will be the year in which HTS goes mainstream. Intelsat will launch EpicNG, and all big 4 will have HTS capacity (each with completely different approaches), Inmarsat started the year launching commercial services on its GX constellation, and regional players are accepting this new technology either with entire HTS satellites or hybrid payloads. Most of the data traffic boom forecasted for the coming years will be captured by HTS systems. NSR’s VSAT and Broadband Satellite Markets, 14th Edition Report, in 2014 HTS systems already accounted for 54% of data traffic for fixed broadband services, but this contribution will grow to reach an astonishing 96% in 2024 illustrating why an HTS play is essential for satellite operators to stay relevant in data verticals.

The key metric for satellite operators has traditionally been fill rates. Fill rates are an accurate measure of success for widebeam FSS satellites in which video is the major application as video is constantly beamed and hence fill rates equate to utilization. An added benefit is that contracts are long term leading to relatively stable transponder prices.

However, HTS systems focus on serving data traffic, and broadband demand is concentrated in peak hours, making fill rates a poor metric for capacity utilization. Furthermore, the large amount of new capacity being launched creates pricing instabilities. All in all, fill rates are a poor predictor of success for an HTS system. If fill rates are no longer applicable, then the question is: how do satellite operators measure the success of an HTS system?

HTS needs to be part of the strategy for any satellite operator targeting data applications. But these investments should not be guided by legacy performance indicators like fill rates. Focusing too much on maximizing fill rates would lead to wrong strategic directions (for example) by exclusively targeting low-value high-volume applications like consumer broadband causing congested beams at peak hours with poor quality of service while missing the high-value opportunities in verticals like mobility or wireless backhaul. It is time for a new set of metrics adapted to the new business models growing around HTS ecosystems that puts satellite operators on the right track for growth and profitability.