[SatNews] The widespread introduction of Shale-gas has had profound impacts across the energy industry – from the increased need for communications into remote areas, to historically low natural gas prices across North America.

However, renewable sources such as Wind or Solar continue to increase their share of the generation portfolio – and the “Smart Grid” continues to hold promise looking towards 2023. Although some of the interest might have dropped off in the near term in expanding Transmission and Distribution (T&D) networks to connect renewable resources, or a temporary shift of focus away from wide-spread IP-ization of the utility market – the demand for connecting infrastructure still remains.

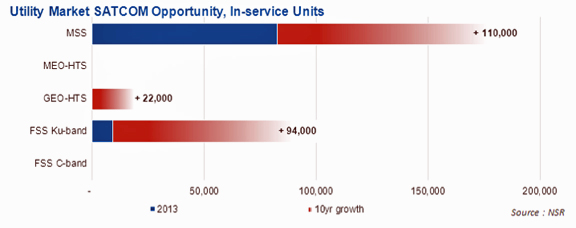

With the market still dominated by MSS form factors that offer easy satellite and terrestrial integration into small footprints, the market for utility satellite communications services remains a market for In-service units, rather than service revenues for bandwidth demand. Although new applications continue to emerge across the industry – from remote video monitoring, to supporting remote workers in semi-manned substations or generating locations – overall bandwidth needs remain minimal. As such, the introduction of GEO-HTS offerings will find their niche in supporting office-centric applications such as VPNs, ERPs, or SAP first, with M2M centric-services taking a distant second.

Even though the near-term outlook slightly favors a steady market for natural-gas sourced electricity, the market for distributed generation and renewable energy in North America and Europe remains strong over the next ten years. With Texas recently producing record levels of wind-sourced electricity, the role these sources play in the overall generation mix will only continue to increase, and as their penetration rates increase, so too does the need for more information to grid operators, plant owners, and utility companies. Data for wind or solar monitoring, enabling better weather predictions, will also be another driver of remote communications need across the generation and T&D sectors.

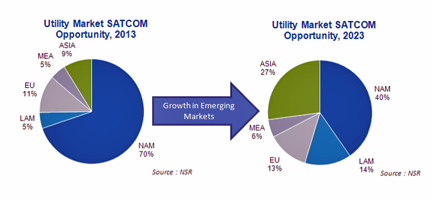

However, developed markets in Europe and North America only tell the story as it stands today; looking forward Latin America and Asia hold tremendous potential. With high natural gas prices, abundant renewable energy sources such as hydroelectric power, and in the case of China, widespread air pollution, an on-going emphasis on distributed generation sources and grid optimization efforts is almost certain.

Even though North America will still account for the largest market in terms of total In-service Units, Asia has the right mix of needs to see a tremendous uptake of satellite communications solutions into the utility market. From a focus on the two R’s – Resiliency and Redundancy – to a rapidly growing need for electrification to meet economic growth targets, the demand is there. Key to satellite’s success will be to focus on the core value-proposition of delivering cost effective, reliable communications into remote environments. Already well understood across North America, taking those experiences into new markets and regions (which have various levels of terrestrial infrastructure) will help drive the adoption of satellite-enabled solutions in these emerging markets.

Even though North America will still account for the largest market in terms of total In-service Units, Asia has the right mix of needs to see a tremendous uptake of satellite communications solutions into the utility market. From a focus on the two R’s – Resiliency and Redundancy – to a rapidly growing need for electrification to meet economic growth targets, the demand is there. Key to satellite’s success will be to focus on the core value-proposition of delivering cost effective, reliable communications into remote environments. Already well understood across North America, taking those experiences into new markets and regions (which have various levels of terrestrial infrastructure) will help drive the adoption of satellite-enabled solutions in these emerging markets.Although the near-term outlook for satellite communications solutions might be low, demand remains within both developed and developing markets. Even with changes in the input price of conventional sources of electricity, the long-term demand for both distributed (usually renewable) generation, and a more-connected Transmission & Distribution infrastructure remains.

The NSR infosite is located at http://www.nsr.com/

Story by