NSR has—for some time—trumpeted the benefit of High Throughput Satellites (HTS) in providing the satellite telecom industry with growth opportunities for a new era of connectivity everywhere, falling prices for data, and increasing competition coupled with oversupply in regions that have long been viewed as growth prospects.

Now, more than ever, this hypothesis has been reinforced with NSR’s Global Satellite Capacity Supply & Demand, 13th Edition showing the future of the satellite telecom industry that success in the future will very much rest within GEO, and eventually Non-GEO, HTS systems.

These HTS systems will, in addition to unlocking completely new markets (aeronautical, backhaul, consumer broadband; i.e., the “ABCs”), also fundamentally alter the business model of satellite operators, gearing them towards more “telco-like” business models. This will have a number of impacts on the future of the satellite telecommunications industry, starting with the most direct impact: Growth will largely come from HTS.

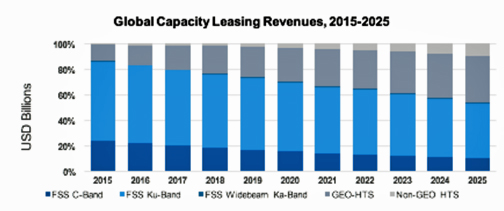

As the chart to the right shows, HTS will grow from approximately 15 percent of total global SATCOM revenues to nearly 50 percent by 2025, with most of this derived from GEO-HTS. Ultimately, NSR believes that satellite operators launching first-mover HTS systems will be able to do a better job of capturing market share from existing players, and there will be some elasticity of demand in these contracts.

Examples include applications such as wireless backhaul, which will see a transition in satellite’s relevance from 2G networks to 3G and 4G, will likely see an increase in total sites, and a huge increase in bandwidth per site. This growth in bandwidth per site will lead to a fundamental alteration in the business model of satellite telcos, from a “luxury product” catering to the 0.1 percent of connectivity needs, to something more mainstream, catering to 1 to 2 percent of global connectivity needs, through a combination of lower cost per bit and lower terminal costs, thus significantly lowering the total cost of ownership.

NSR forecasts this growth in leased capacity to come at a significant discount in terms of cost per Mbps. For example, in its most recent GSCSD13 study, NSR expects a 22-fold increase in capacity demand for HTS between 2015 and 2025, which corresponds to “only” a four-fold increase in revenues. This comes about as FSS revenues are more or less flat, with the majority of future cash flows coming from long-term video contracts at established orbital slots with limited opportunity for growth from competing operators.

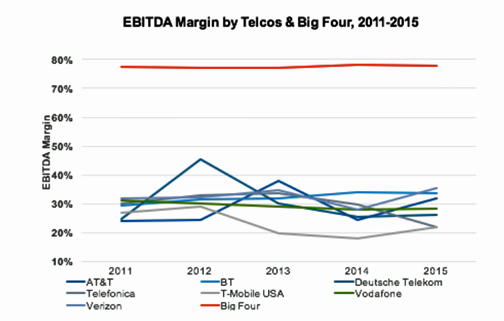

With growth coming largely from HTS, NSR expects a second major theme to occur within the satellite telecom industry moving forward, that being an EBITDA margin that starts to become more similar to that of terrestrial telcos. As noted in its Satellite Operator Financial Analysis, 6th Edition (SOFA6), NSR expects operators to start investing more into elements such as distribution networks, acquisition of partners, and other non-satellite CAPEX in order to reduce the distance between satellite operator and end-user.

Overall, this is all part of the transition from Space 1.0 to Space 2.0, which NSR sees as a transition from selling MHz to selling Mbps and from making Mbps to making value. This is seen as a significant shift from niche to “bigger niche,” which is absolutely necessary when faced with falling prices, and also perhaps not the worst outcome when faced with falling CAPEX costs.

In short, satellite operators are currently in the midst of a tenuous balancing act between seeing a lowered cost of capacity to orbit, a lower cost of capacity sold to end users, and an expansion of addressable market beyond the 0.1 percent that has been previously served by satellite operators. Time will tell who gets this equation right.