Eutelsat Communications (ISIN: FR0010221234 - Euronext Paris: ETL) has reported their revenues for the First Quarter ended 30 September 2017.

Rodolphe Belmer, Chief Executive Officer, stated, "First Quarter revenues were in line with our expectations. Our key operational metrics were well oriented with a further rise in HD penetration, a stabilization of the Backlog and an improved Fill Rate on a quarter-on-quarter basis. The Fall renewal campaign with the US Government yielded a favorable outturn, at some 95% in value while the outcomes of Video renewals during the quarter were positive, notably with Polsat on HOTBIRD. Elsewhere we took further measures to optimise Video distribution with the absorption of Noorsat in the MENA region.

"For the remainder of the year, revenues in our Core Businesses are on track, and Mobility will further benefit from the entry into service of EUTELSAT 172B in November. However, the late availability of the payload leased on the Al Yah 3 satellite, representing the majority of the capacity dedicated to Konnect Africa, will push out revenues in Fixed Broadband. In recognition of this delay, revenue expectations for FY 2017-18 are mechanically adjusted from ‘broadly stable’ to between -1 and -2%. This adjustment will not affect our ability to attain our other objectives, in particular EBITDA margin and discretionary free cashflow, which are all re-affirmed for the current and future years.”

The key events of Eutelsat's First Quarter were as follows:

- Q1 revenues down 1.0% at constant currency and perimeter and excluding ‘Other’ revenues;

- Well-oriented operational metrics, with a further rise in HD penetration as well as a stabilisation of the Backlog and an improved Fill Rate on a quarter-on-quarter basis;

- Favourable outcome of the US Government Fall renewals with arate of almost 95% in value;

- Positive outcome of Video contract renewals, notably with Cyfrowy Polsat on HOTBIRD;

- Absorption of Noorsat to optimise Video distribution in the MENA region;

- Delayed availability of Al Yah 3 capacity impacting Konnect Africa ramp-up. All other verticals on track.

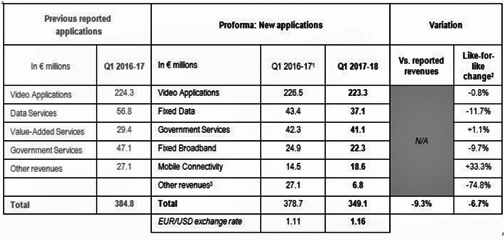

[1]Proforma revenues reflecting disposals of Wins/DHI and DSAT Cinema. For more details, please refer to the appendices.

[2]At constant currency and perimeter.

[3]Other revenues include mainly compensation paid on the settlement of business-related litigation, the impact of EUR/USD currency hedging, the provision of various services or consulting/engineering fees as well as termination fees.

Note: Since its First Half 206-17 results on February 9, 2017, Eutelsat publishes revenues on the basis of five applications: Video, Fixed Data and Government Services (Core Businesses), Fixed Broadband and Mobile Connectivity (Connectivity).