[SatNews] A recent Morgan Stanley report issued at the end of September 2013 takes on the FSS sector, claiming the industry has entered a “no-growth” cycle and that “HTS will struggle to find a market”.

[SatNews] A recent Morgan Stanley report issued at the end of September 2013 takes on the FSS sector, claiming the industry has entered a “no-growth” cycle and that “HTS will struggle to find a market”.

The report goes on to make numerous specific assessments and claims about trends in the FSS industry, and in particular, the report is fairly dismissive about the eventual success of newly emerging HTS platforms, at least in the short- to mid-term.

Overall, NSR feels that the Morgan Stanley report authors have to a large degree misread the current trends in the FSS sector and that they have treated some specific, real issues with too broad a brushstroke in how they impact the entirety of the FSS sector. In the narrowest of terms, the Morgan Stanley report was nominally meant to assess the revenue growth outlook for SES and Eutelsat over the next 3-5 years. And within this very specific context, the report did correctly highlight a number of real issues that will likely have an impact, both positive and negative, on SES’ and Eutelsat’s revenue performance through to 2018.

Where the Morgan Stanley report falls down, and in quite a dramatic fashion, is how it parlayed these specific issues related to SES and Eutelsat into a relatively scathing assessment of the overall FSS sector and, in particular, for emerging HTS services. NSR could engage in a long point-by-point critique of the Morgan Stanley report on where we have agreements and disagreements; however, the most fundamental issue that seems to be missed by the report authors is what NSR sees as the true necessity of the satellite industry to move down the path towards High Throughput Satellites. And, interestingly, the Morgan Stanley report raises many of the issues of why this needs to happen but fails to make, or incorrectly makes, the connections.

In particular, the Morgan Stanley report notes that, to their “surprise”, the main threat to growth in the FSS industry comes from terrestrial networks and fiber. Specifically in terms of data-type applications, NSR would actually agree that terrestrial networks and fiber are the greatest long-term threat to revenue growth. However, Morgan Stanley more or less interprets the FSS sector’s response to the fiber and terrestrial network threat, which is the launch of new High Throughput Satellites, as a failure to date and endlessly laments about the negative impact that HTS capacity is having on FSS revenues by driving down pricing on classic C/Ku-band capacity.

NSR’s simple answer to this assessment is that if the satellite industry did not change, it was already on the path of losing this business anyway regardless of the short-term impact on C/Ku pricing. A specific case in point is the trunking segment. Even Morgan Stanley’s researcher noted that C/Ku leasing revenues for trunking only represent 2-3% of Eutelsat’s and SES revenues base. The connection that Morgan Stanley has fundamentally missed is that the new HTS architectures ― here NSR includes any spot-beam, high frequency reuse payload as well as the medium earth orbit networks (MEO-HTS) like O3b ― will be able to recapture some of this market demand and even likely grow the revenue base for data services and applications that were fading from the classic C/Ku capacity repertoire. This includes not only services such as trunking but also consumer broadband access, VSAT networking and other related data markets.

It is NSR’s clear view that the satellite industry today must make the investment in the new HTS architectures in order to remain relevant in the mid- to long-term to clients for data-type services. Does that mean there won’t be negative impacts short-term? Of course there will. In any industry in transition, competition among players will be high, mistakes will be made, and markets misread. Part of the process of learning what can be done with the new HTS architectures and what will emerge in terms of business that could not even be initially imagined is part of the process. When Thaicom first undertook development of its IPSTAR project, did it ever imagine that a core service would become cell backhaul services for SoftBank in Japan? Yet, this has turned out to be the case and has caused a revelation in the industry about the types of services and applications that can be successful addressed with HTS capacity. A related example would be the strong uptake of Thaicom-4/IPSTAR capacity in Malaysia for government-backed rural connectivity/social inclusion projects. Another interesting emerging niche application that few expected is for SNG services with Eutelsat’s NewsSpotter service apparently being the “hot thing” for the SNG crowd at the 2013 IBC Conference.

NSR labels the transition that is occurring in the FSS sector ― a transition that will admittedly take many years and not without some stumbles on the way ― as the “bifurcation” within the FSS segment. In this model, all of the different satellite services and applications that in the past were only served by the same architecture of widebeam C/Ku-band capacity will gradually segment into different types of satellite architectures with each architecture best designed to serve, and grow, specific satellite applications and segments.

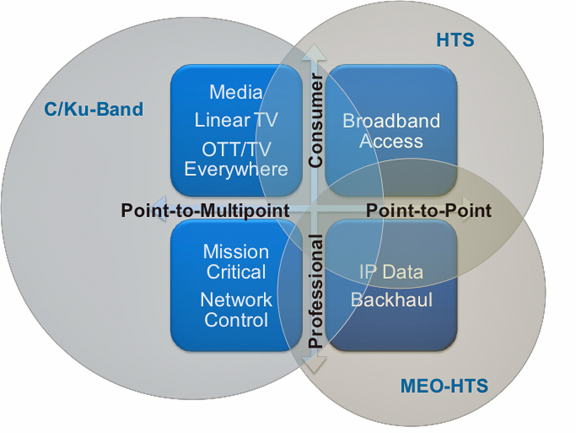

There will always be some overlap between the architectures, especially during the period of transition; however, in very overarching terms, NSR continues to fundamentally believe that classic FSS C/Ku-band capacity, with its unbeatable point-to-multipoint strength, will continue to successfully serve the classic sectors like video/media distribution to consumers as well as applications that require a professional grade of point-to-multipoint services. HTS capacity will see much of its capacity used for consumer-class point-to-point services like broadband access, but also overlap significantly into the point-to-point and point-to-multipoint areas for professional services where the cost per bit is the dominant decision point for the end client. Finally, MEO-HTS architectures (i.e. O3b) will play best in the point-to-point professional category of services like trunking and backhaul.

NSR’s Satellite Sector Bifurcation Model.

NSR Bottom Line

Will every HTS that is launched be successful? No, just as in any technology driven industry there are always leaders and followers, those who successfully interpret the market and those who significantly misread the market trends. Will the industry be able to completely avoid oversupply and internal price competition between operators? Again, the answer is “no” since every operator has to develop its own strategy and if one of them stumbles along the way, their missteps will have unavoidable consequences on those around them.

But should the emerging HTS services already be judged largely as a failure or a threat to the existing services? In NSR’s view, absolutely not. The satellite sector must find ways to better serve its clients, and one absolutely key criteria of success in the future will be to drive fundamentally down, and keep driving down, the cost per bit delivered across a whole spectrum of services and applications. The trend towards HTS is creating what NSR has labeled the “bifurcation” of the market. But to already wholesale condemn the bifurcation of the market as done by Morgan Stanley shows a major lack of insight as to where the sectors needs to go in the coming years. Only by truly understanding the long-term trends can industry experts, including our banker and financial advisor colleagues, be able to judge the real prospects of each player in the sector.

This article is by Senior Analyst, NSR Singapore, Patrick French. For further information regarding NSR, please access this direct link to their website.