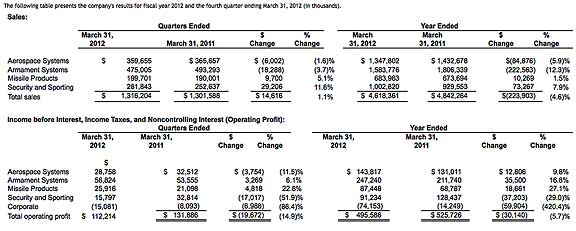

The company achieved full-year sales of $4.6 billion, down five percent from the prior year, which is in line with its FY12 guidance. For the full year, net income was down 16 percent to $263 million, compared to $313 million in the prior year. Full-year earnings per share (EPS) were $7.93, compared to $9.32 in the prior year. Adjusted EPS increased to $8.78 from $8.65 (see reconciliation table for details). The increase was driven by updated profitability expectations on energetics and other programs, and continued operating efficiencies, partially offset by margin pressures in the Security and Sporting group and reductions in sales volume in the Armament Systems and Aerospace Systems groups. Full-year operating margins were 10.7 percent. Orders for the year were $4.2 billion. Full-year free cash flow was $250 million, compared to $291 million in the prior year (see reconciliation table for details). The current year included $75 million of contributions to the company's pension plans, compared to $8 million the prior year.

Sales of $1.3 billion in the fourth quarter were up one percent from the prior-year quarter. Higher sales in the company's Commercial Ammunition and Defense Electronics Systems businesses contributed to the increase, offset by lower sales in the Aerospace Systems and Armament Systems groups. Fourth quarter margins were 8.5 percent. Fourth quarter fully diluted EPS were $1.86, compared to $2.10 per share in the prior-year quarter. The lower EPS reflect the continued margin pressure in the Security and Sporting group, charges incurred for the company realignment, and higher pension expense, partially offset by updated profit expectations as ATK nears completion of energetics and other programs, as well as operating efficiencies. Orders in the fourth quarter were $1.5 billion, a book-to-bill ratio of 1.1, driven by strong demand in the Security and Sporting group.

This table presents the company's results for fiscal year 2012 and the fourth quarter ending March 31, 2012 (in thousands).

"In FY12, ATK announced a realignment of our business groups, continued expansion of our accessories business, distributed $77 million to shareholders in dividends and share repurchases, and retired $320 million in debt to strengthen our balance sheet," said Mark DeYoung, President and Chief Executive Officer. "More importantly, ATK is committed to generating long-term shareholder value. The company operates under a management model that is focused on improving operating efficiencies and delivering innovative, cost effective products that meet the needs of our customers. We believe this strategy will serve us well in this budget constrained environment." To read the entire financial report, access this directly infolink.