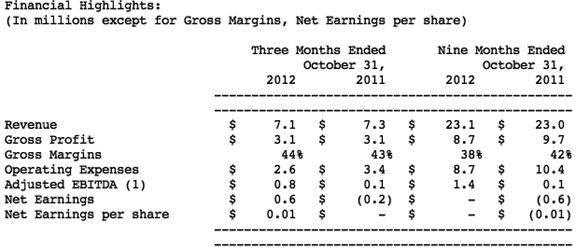

...three and nine month periods ended October 31, 2012. All figures are in Canadian dollars, unless otherwise stated.

For the third quarter of fiscal 2013, total revenue was $7.1 million, down 2 percent from $7.3 million in the prior year. IDC Systems revenue declined 54 percent, while IDC Products revenue increased by 24 percent. This increase in revenues from the IDC Products segment was driven by higher sales for our SuperFlex™ and STAR Pro Audio product lines, resulting from large contracts in France and in Thailand. The decline in revenues from the IDC Systems segment was largely due to the completion of the first phase roll-out of the DTH Broadcasting project in Kenya in the first quarter of fiscal 2013.

IDC generated positive adjusted EBITDA of $782,000 during the current quarter, up from $59,000 from the comparable prior period. This improvement in EBITDA was largely due to lower operating expenses including a 19 percent reduction in Selling, General and Administration and a 32 percent decrease in Research and Development costs.

"IDC is actively reviewing and revising our global sales and distribution strategy," stated Del Lippert, Interim CEO and Chairman of the Board. "For example, our new Digital Tattoo™ offering is a prime DTH and IPTV product that is very relevant to emerging markets such as Asia and Africa. By reallocating and expanding key resources to meet the needs of Master Distributors and OEM customers in these target regions, we believe that we can directly enhance our market position and in turn stimulate the growth that our shareholders expect from IDC."

To read the entire financial report, select this direct link.