Intelek shareholders will receive 32 pence in cash for each Intelek Share. This values the entire existing issued ordinary share capital of Intelek at approximately 28 million pounds. The Intelek Directors, who have been so advised by Altium, consider the offer terms to be fair and reasonable for all concerned and their intention is to unanimously recommend Intelek Shareholders accepts the Teledyne offer.

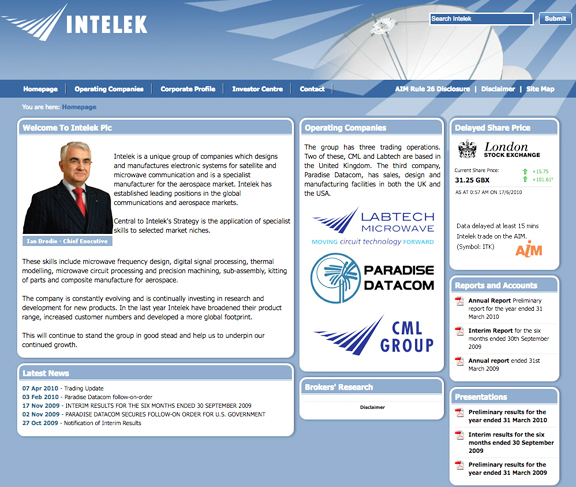

Teledyne is a NYSE listed company with a market capitalization of US$1.4 billion and 2009 revenues of approximately US$1.8 billion. INtelek is an AIM quoted company in the business of designing and manufacturing electronic systems for satellite and microwave communciations, with a focus on the defense and SATCOM markets.

Robert Mehrabian, Chairman, President and Chief Executive Officer of Teledyne, said, "We are delighted that the directors of Intelek have decided unanimously to recommend the Offer to their shareholders which is at a significant premium to Intelek's share price in the 12 months prior to the Offer date. The combination of Intelek with Teledyne should place Intelek in a much stronger position to realise its growth potential". And Ian Brodie, Chief Executive Officer of Intelek, said, "The directors of Intelek have focused our strategy on further developing our satellite and microwave communications business as a core value driver for the Intelek Group. This Offer for Intelek is at a substantial premium and we unanimously recommend that shareholders accept this Offer".

Teledyne is organized into four business market segments...

- Electronics and Communications (defence electronics, including microwave devices, interconnects and imaging sensors; electronic instrumentation; and other commercial electronics, including aircraft information management systems)

- Engineered Systems (engineered systems for defence, space, environmental and nuclear applications)

- Aerospace Engines and Components (OEM and aftermarket general aviation piston engines and spare parts)

- Energy and Power Systems (energy generation systems, aviation batteries and military turbine engines)

Intelek has three divisions...

- Paradise Datacom — designs and manufactures satellite modems, transceivers, block up-converters, solid state power amplifiers, low noise amplifiers and associated equipment for the terrestrial segment of the satellite communications market. Paradise Datacom has sales, design and manufacturing facilities in both the United Kingdom and the United States

- Labtech — a manufacturer of microwave circuit solutions with specialist capabilities in design, manufacturing, assembly and testing across many technologies, product and market applications from defence electronics, global telecommunications to space and satellite communications. Labtech is based in the United Kingdom

- CML — manufactures precision machined and composite aerostructures for military and commercial aircraft. CML is based in the United Kingdom