UltraHD has been big in the headlines recently, with its flashy new technology easily captivating the consumer tech sphere.

Hype about the new TV format remains high; however, how does this hype translate to revenue opportunities for satellite operators and pay TV platforms?

First, it is important to recognize the earliest UltraHD traction began online, with a number of OTT platforms such as Netflix, Ultraflix and Amazon Prime delivering UltraHD content over the Internet. For many consumers, this will be the first experience for UltraHD due to the lack of dedicated equipment required. In many cases, however, consumers miss out on the full 4K resolution and the enhanced color spectrum that UltraHD allows in its specification. While OTT platforms obtaining UltraHD content first is highly different from the transition from SD to HD, there are strong opportunities ahead on linear pay TV platforms in this new format.

Beyond OTT, however, DTH traction is gaining with platforms such as KT Sat in Korea, Sky PerfecTV! In Japan, and HD+ broadcasting in Germany moving forward. Meanwhile, many other channels are being broadcast free-to-air (FTA) in most regions today, with Europe, East Asia and North America being the primary focus at end of year 2015.

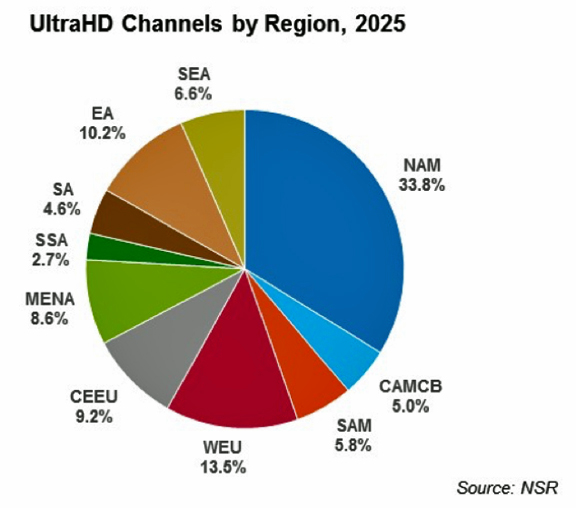

NSR expects approximately 785 UltraHD channels broadcasting by 2025, as noted in the recently released UltraHD via Satellite, 3rd Edition. This represents a slight downward revision from the previous NSR study, which forecasted over 820 channels broadcasting in 2025. This revision reflects a slightly slower rollout phase in the short term for UltraHD, with NSR indicating that it will take an additional few months past 2025 to reach the same 824 channels globally. Furthermore, declines in HEVC chipset pricing are taking longer to reach levels that will lead to widespread adoption. This is especially important for ROI considerations when pay TV platforms subsidize set top boxes on a large scale.

Nevertheless, NSR’s view remains that the fundamentals of UltraHD remain strong. This is driven by a competitive pay TV environment, commoditization of earlier formats, and most importantly, historically low pricing driving 4K TV penetration in consumers’ homes. Consumers can now purchase a 42 inch 4K TV for as low as US$334 in some markets.

Beyond this, standards are being finalized, and along with the exponentially increasing shipments of UltraHD TVs, the pieces of the UltraHD puzzle are finally beginning to come together. This will drive higher ARPUs, higher leasing revenues, and global growth opportunities long term.

Strategic issues remain though, with the willingness of consumers to pay additional charges for UltraHD content yet to be proven. However, NSR expects that once consumers whet their appetite for “free” (bundled) UltraHD channels, subscribers will generally pay for the content longer term. Developing markets will see a similar narrative, however, as UltraHD will be used primarily as a marketing tool to bring in the relatively small number of Ultra-Premium subscribers, as well as the large market that exists of first-time TV households.

Overall, the fundamentals of UltraHD broadcasting via satellite remain strong, with robust commitments made by most high-profile satellite operators led by SES, in addition to a handful of regional operators such as SingTel, TurkSat and AsiaSat. Now is a critical point in the development of UltraHD business models as commercialized UltraHD content has become available, and nearly all regions will have linear UltraHD content in 2017.

While in the short term there will be ROI concerns, namely the limited direct revenue increases associated with UltraHD, the longer term is far more certain to derive revenues through additional fees for UltraHD packages, and indirect revenues by some platforms when used as a retention strategy.

Report by Alan Crisp,

Analyst,

NSR Hong Kong