[SatNews] ...is still a small company ...it is therefore interesting that the company has managed to finance a third satellite with a cost in the hundreds of millions of dollars range.

In less than a decade, a new entrant has come into the satellite operator picture, that being Avanti Communications of London, UK. Avanti is rather unique in that almost their entire fleet moving forward will consist of commercial High Throughput Satellite (HTS) payloads, with the exception of ARTEMIS, a multi-mission satellite in collaboration with ESA. The other differentiator is that their supply is almost exclusively Ka-band apart from the one beam on Hylas-1. This somewhat restricts their play to largely enterprise data applications in the regions they operate. NSR can’t help but wonder if this niche is a conscious decision and more importantly, will it pay off?

Indeed, Avanti made the news again earlier this month with the announcement that a third HTS payload—HYLAS-4—would be procured from Orbital Sciences Corporation. This caught NSR’s eye because, by all measures, Avanti is still a small company, with July to December 2013 revenues of ~$25 million, or around 2 percent of an average half-year for Intelsat or SES, and it is therefore interesting that the company has managed to finance a third satellite with a cost in the hundreds of millions of dollars range. Avanti market cap was about $330 million at last closing, again an order of magnitude lower than any of the Big 4. Further, despite an impressive backlog of nearly half a billion dollars, backlog growth was flat in 2013, following 60 percent backlog growth in 2012. Unquestionably, Avanti has done an impressive job of raising funds and expanding their fleet. This can be attributed, in no small part, to the C-level team of an ex-investment banker as CEO and a satellite industry veteran as CTO. However, it is important to ask and subsequently analyze whether an “All-in” bet on HTS infrastructure will be a sustainable business model in the long term.

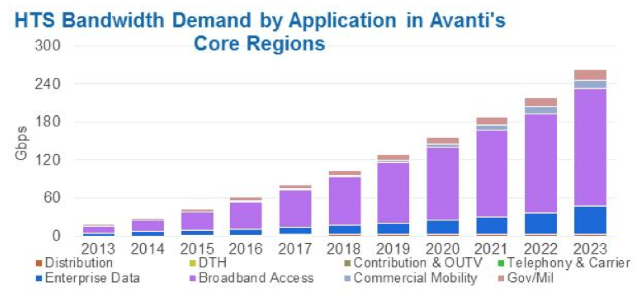

Using data from NSR’s Global Satellite Capacity Supply & Demand, 11th Edition, we can pinpoint the addressable market for Avanti’s satellite fleet, under the assumption that their core areas of operation will be Western Europe, Central & Eastern Europe, Middle East & North Africa, and Sub-Saharan Africa. Taking this as Avanti’s “Core Regions”, we conclude that by 2023, there will be just over 250 Gbps of HTS demand, with the majority (over 180 Gbps, or 70% of total demand) coming from consumer broadband, particularly in Western Europe.

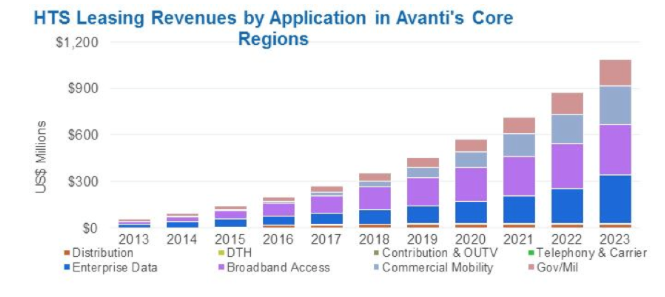

When looking at the revenue picture for this set of regions, however, a very different trend emerges. While broadband is still the largest revenue driver of any application, it accounts for only about 30% of total revenues. Of just under $1.1 billion in total revenues, broadband will account for around $325M. Other major revenue drivers for HTS will be Enterprise Data, in particular trunking and backhaul in developing regions. Commercial Mobility will also contribute nearly $250M, driven by in-flight connectivity and other sub-applications. All said, the revenue picture will be much more balanced than the demand side, something that lends credence to the fact that not all HTS payloads need to be strictly focused on consumer broadband.

The same region will add more than 500 Gbps of HTS supply in the next decade, which paints a cautiously optimistic 50 percent fill rate picture by 2023. Can Avanti beat this market average? And what role will predatory pricing have to play in achieving that success? And one must bear in mind that the bulk of these supply and demand figures are attributed to Western Europe, where systems like KA-Sat are yet to find their own in terms of profitable return on HTS supply. Africa and the Middle East, where Avanti is placing its bets, may be even tougher markets to deliver high revenue numbers.

Bottom Line

Looking at the above factors in their regions of greatest emphasis, Avanti (and other HTS operators) will see healthy demand growth moving forward. However, the question to be asked is whether there will be enough demand growth to justify the tremendous investments placed into HTS payloads already. With the HTS revolution showing no signs of slowing, will there be a bubble leading to large HTS payloads with negligible fill rates, or will supplementary demand be brought about by more supply, with the need for lower bandwidth pricing leading to more affordable HTS capacity? Overall, Avanti is putting a lot of eggs into the HTS basket, at a time when even the Big Four, with their substantial CAPEX budgets and global presence, are playing it more cautiously. While this gamble may pay off in the end, at this point the all-HTS business model seems to be a move that could put Avanti in a precarious situation should they find themselves going head-to-head with the big boys over the global HTS markets.